25+ How much can i borrow fha

One of the first questions you ask when you want to buy a home is how much house can I afford. FHA loans come with a 15- 20- 25- or 30-year term and have a fixed interest rate.

What Are Aaa Mortgage Loans Quora

Compare and see which option is better for you after interest fees and rates.

. FHA loans typically allow for a lower down payment and credit score if certain requirements are met. The lowest down payment is 35 for credit scores that are 580 or higher. How buying a house changes your life.

A mortgage would allow you to make that 30000 payment while a lender gives. Learn more about how to prequalify. Borrowers with lower credit scores between 500 to 579 can also secure an FHA loan provided they pay at least 10 down.

The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. According to the Department of Housing and Urban Development the maximum FHA lending amount for high-cost areas such as large metropolitan areas is up to 970800 for 2022. Heres how much you can expect to pay now to finance that future cash flow.

For FHA Streamline Refinances MIP refunds are available after the 7-month waiting period required for these loans. A 100K salary puts you in a good position to buy a home. 1 Buy 25 Companies.

You choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. The more you borrow from your bank the more interest youll need to repay. Best FHA Mortgage Lenders.

Its important to know how much youll be able to borrow before you find a house. In general you can borrow the greater of 10000 or 50 of your vested account balance up to 50000. For example you probably cant pay 400000 for a home upfront however maybe you can afford to pay 30000 upfront.

You can borrow the entire balance if you want but that means youll need to return the entire amount pre-tax to avoid unnecessary costs. The Federal Housing Administration backs FHA loans. FHA LOAN TERMS FOR MOBILE HOMES The terms of an FHA loan for mobile homes include a fixed interest rate for the entire 20-year term of the loan in most cases.

Borrowers who use this program to buy a house can only use funds from an approved source. The monthly payment is a comfortable 25 of your income and the down payment is less than the amount you specified. VA Streamline Refi 2022 March 25 2022 FHA.

Your refinance loan closing must happen by the end of the 36th month after the current FHA loan was opened. How expensive of a home can I afford with an FHA loan. See if youre eligible for a FHA refinance loan Sep 15th 2022 Can I get the FHA MIP refund in cash.

If your credit score is between 500-579 you may still qualify for an FHA loan with a 10 down payment. In many cases homebuyers can borrow up to 548250 with a VA loan but you may be able to borrow more in areas with a higher cost of living. However these limits can be higher under certain circumstances.

Down payment funds may come from savings cash saved at home investments and more. The outstanding loan amount. Mortgage rates close in on 6 highest since 2008.

You can calculate your mortgage qualification based on income purchase price or total monthly payment. The maximum term is 15 years for a lot-only purchase. Keep reading below for a closer look.

HUD Handbook 40001 outlines the acceptable down payment sources for FHA loans. You are limited to the balance in your current companys 401k not the collective balance. If your credit isnt great and you have little money to put down an FHA 203k loan might be best since you can get a mortgage with only 35 percent down.

Learn more about how much youll need. FHA mortgages are a good option especially for first-time homebuyers and borrowers with limited income. See the monthly cost on a 250000 mortgage over 15- or 30-years.

With a 100000 salary you have a shot at. As of 2021 you can borrow up to 965 of the value of a home with an FHA loan. The basic FHA program offers a low 35 down payment as long as you have a credit score of 580.

We calculate how much money you can borrow based on your income and monthly debt payments. FHA loans which are backed by the Federal Housing Administration require as little as 35 down if you have a credit score thats at least 580. The qualifying standards of FHA loans make home buying more accessible for a greater number of people.

The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie Mac. That term can be extended up to 25 years for a loan for a multi-section mobile home and lot. As you gradually pay off the money you borrow you will be paying interest on a smaller loan amount and your interest payments will slowly reduce.

Theres a maximum limit to what you can borrow for an FHA loan and how much you can borrow depends on the county in which your potential home is located. FHA-insured loans are meant to help people with low or no credit high debt or low funds qualify for a mortgage. Mortgage Costs Resulting Amount.

For example 5 of 1 million will always be a larger amount than 5 of 500000. Estimate the cost of your project. Key highlights from this article.

You can try an FHA loan its underwriting is much more lenient.

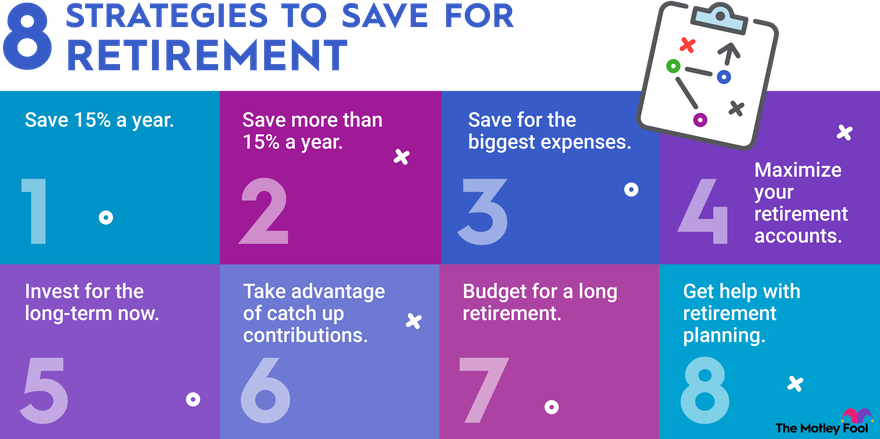

8 Best Strategies For Retirement The Motley Fool

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2018 Fha V Fha Loans Conventional Loan Mortgage Loans

Can I Get A New Home Loan Even Though I Have An Existing Home Loan Quora

Mortgage Calculators Mortgage Calculator Mortgage Refinance Mortgage

Plans Basically Designed For Fha Financing Small Homes Engineered Homes Ranch Type Homes 2 And 3 Bedroom Homes American Plan Service Free Download Bor Mid Century Modern House Plans How

Plans Basically Designed For Fha Financing Small Homes Engineered Homes Ranch Type Homes 2 And 3 Bedroom Homes American Plan Service Free Download Bor How To Plan Vintage House Plans

Dividend Kings List And Definition

Houston Fha Loan Limits For 2021 Texas United Mortgage

Are You Having An Openhouse Get A High Quality Flyer Customized To Your Property With A Rate Table Prepare Mortgage Loans Mortgage Marketing Mortgage Savings

Interest Expense Formula How To Calculate

Yoecnbir2kw Fm

What Credit Score Is Needed To Buy A House Credit Score Credit Score Chart Credit Score Repair

San Antonio Fha Loan Limits For 2021 Texas United Mortgage

Get Ultimate Guidance On The 7 Best Mortgage Refinance Companies

What Is An Fha 203 K Loan Texas United Mortgage

Pin On Stockcabinetexpress Infographics

How To Buy A Home When You Have Bad Credit